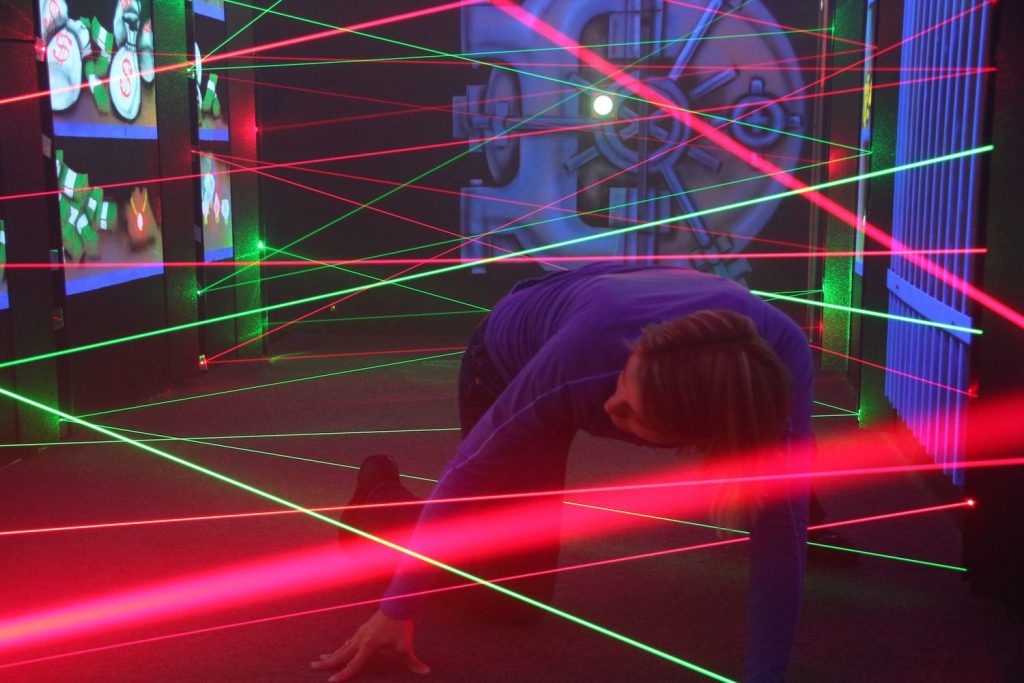

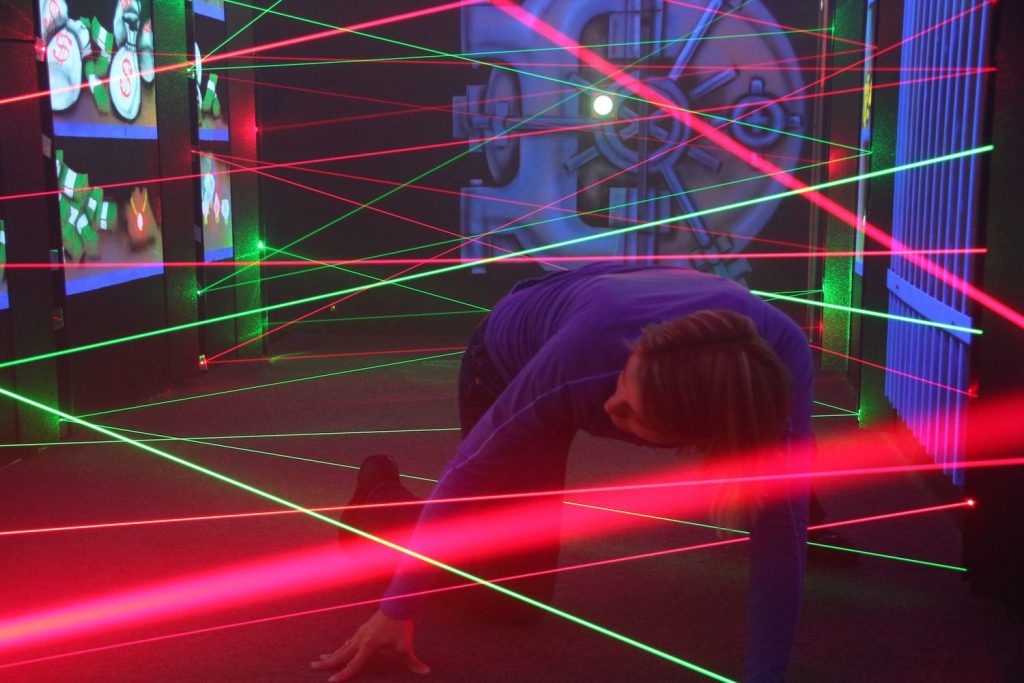

Following my last article on tips for Limited Recourse Borrowing Arrangements (LRBA) in your Self-Managed Super Fund (SMSF), I thought I would follow-up by highlighting some common traps that are all too common out there. Unfortunately these traps catch out many Australians and can create some painful & costly problems, make sure you don’t get caught by them.

Traps to Avoid

Trap 1: LRBA investment allowed?

Before investing, do significant research and homework to make sure LRBA investing is allowed within your SMSF.

Check to see if LRBA and leveraged property investment is allowed by both your investment strategy and your trust deed. It may be required that need to update your deed. One of the first thing I do is read the deed for the client to make sure the strategy is allowed.

Trap 2: Falling for the high-pressure sale

There is much money to be made by unqualified spruikers selling properties to SMSF investors. Don’t become one of their growing number of poor victims.

Avoid the high-pressure, glossy sales pitch presented at seemingly professional seminars. Before you commit to anything, pay for an independent property valuation; the peace of mind this will give you is well worth it.

Trap 3: Not knowing the development rules

Be mindful that using borrowed funds to improve (or develop) a property is a no-no. Ensure you have a clear understanding of what is meant by repair, maintenance and improvement before you do any work on the property and always seek professional advice.

Trap 4: Keep financials above-board

Don’t try to cut corners on your financials. Pay market value for the property and pay markets rates for the interest.

Avoid the spruikers who continue to push the lure of the zero-interest loan strategies. If you’ve got one already in place, speak to an expert about correcting it. The ATO has quite rightly clamped down on this strategy and the fines can be horrendous.

Trap 5: Having no exit strategy

Ensure you have a clear exit strategy for the LRBA and the property investment. Understand the tax likely implications upon sale (depending on your age and retirement status) and the mechanics of how the LRBA will be paid off.

Strategically, the majority of LRBAs are wound up prior to retirement, which intuitively makes sense. This is when the tax effectiveness of an LRBA strategy is lost.

Follow the tips, avoid the traps.

When executed well, an LRBA within your SMSF can be a wonderfully effective investment strategy. However, having trusted, expert, professional advice is incredibly important. Not following these basic tips or falling into one of these traps can mean your LRBA can cost you dearly with double or even triple stamp duty, confusion over ownership and SMSF audit problems.

Anthony Pears is an accredited SMSF Specialist Advisor™ (SSA™).